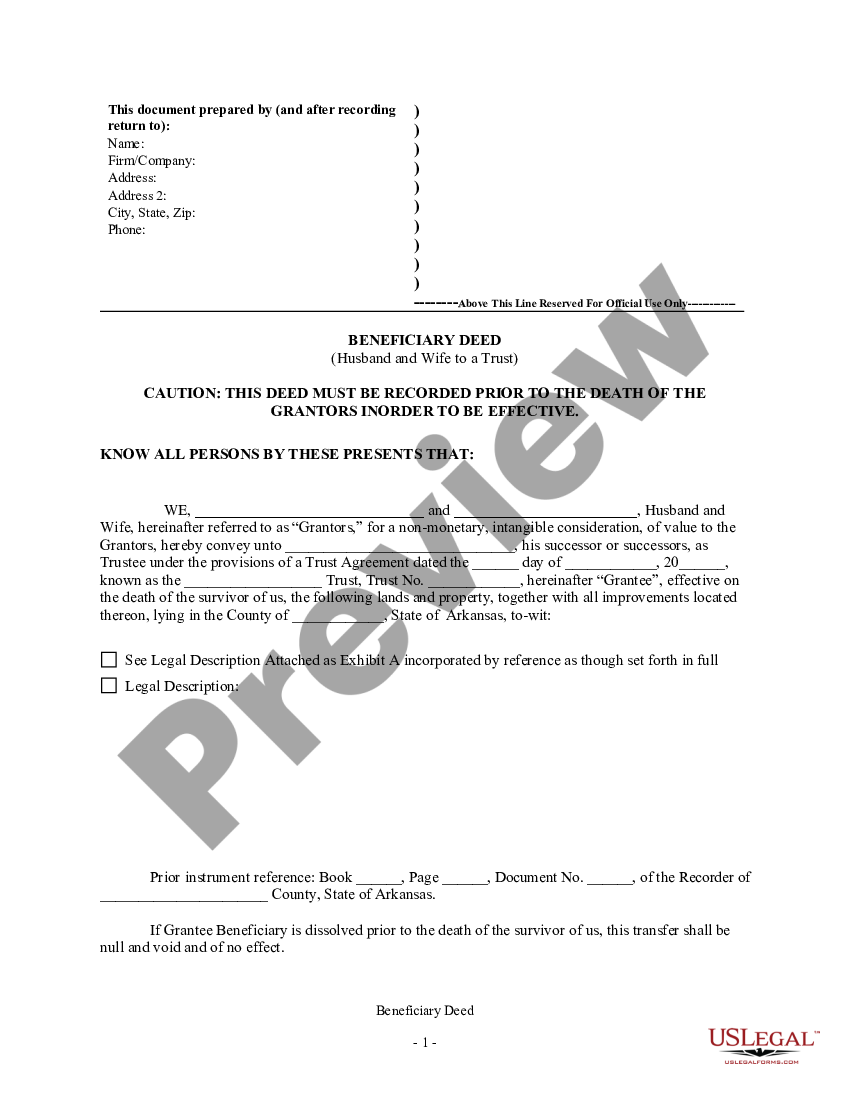

In order for a Transfer on Death Deed to be effective, all elements of a properly recorded deed must be met. How Do I Go about Creating a Transfer on Death Deed?Īlthough creating a Transfer on Death Deed is not as in-depth of a process as creating a Revocable Living Trust, it should still be accomplished by an experienced attorney. Revocable Living Trusts, as opposed to Transfer on Death Deeds, can provide some level of divorce and creditor protection, allow for transfer in case of incapacity (rather than exclusively after death), manage assets for the benefit of a minor or an incapacitated individual, and are private, easily changed, and endlessly customizable. A Transfer on Death Deed also does not shield the property from a beneficiary’s creditors or trouble with spending (unlike a Revocable Living Trust, which would achieve both of these goals). Land records are public and easily accessible. Unlike other methods for avoiding probate, using a Transfer on Death Deed does not protect the privacy of the transferor or the beneficiary. Why Might I NOT Want to Use a Transfer on Death Deed? They are binding as long as they are left recorded in the land records. Transfer on Death Deeds cannot be altered by a Will or a Trust. This can save time and prevent potential disputes.

It is true that, by properly recording a Transfer on Death Deed, real property can be transferred to a new owner without that property passing through the probate process.

Why Would I Want to Consider a Transfer on Death Deed?Īt Wakefield Law, a lot of clients ask us about Transfer on Death Deeds as a way to keep real property out of probate.

#DTRANSFER ON DEATH DEED CO BENFICIARIES FULL#

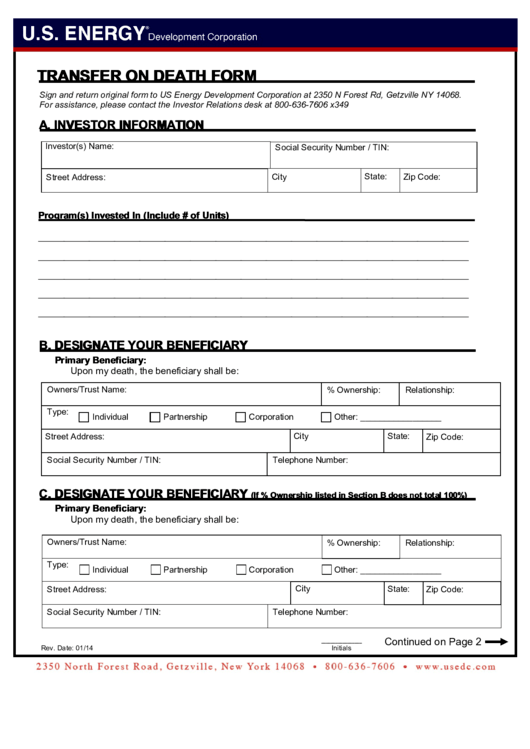

Adding a joint tenant gives full ownership rights to the co-owner immediately, even while the transferor is still alive. This is one main difference between recording a Transfer on Death Deed and adding a joint tenant onto the existing deed. While the transferor is alive, he or she retains all ownership rights and interests in the property. In order to change or revoke a Transfer on Death Deed, the property owner needs to either file a new Transfer on Death Deed that changes or revokes the previous one or file an instrument of revocation that expressly revokes the transfer. Transfer on Death Deeds, because they don’t go into effect until the transferor dies, are revocable and can be changed at any time prior to the transferor’s death. Once the transferor dies, title to the property immediately goes to the beneficiaries listed, and they immediately take on any mortgages, liens, and contracts to which the property is subject. If the property is owned by more than one owner in joint tenancy, a Transfer on Death Deed must be signed by all owners in order to be effective. In order to be effective, a Transfer on Death Deed must be in writing and properly recorded prior to the transferor’s death in the land records of the Circuit Court Clerk’s Office of the jurisdiction where the property is located. In July of 2013, the Commonwealth of Virginia adopted the Uniform Real Property Transfer on Death Act, permitting an individual to transfer real property to a beneficiary using a “Transfer on Death Deed.” Basically, this is a filing recorded in the land records that tells the local jurisdiction that, upon the death of the transferor, ownership of the property will automatically and immediately transfer to the named beneficiary or beneficiaries. placing the property into a Revocable Living Trust, which also keeps the property out of probate but also confers a wide range of benefits as well. recording a Transfer on Death Deed, which keeps the property out of probate, and 3. transfer using a Will, which requires the property to pass through probate, 2. The most common methods we discuss in estate planning, however, are 1. Of course, there are many ways to transfer real property from one person to another. For many, a home is the largest and most valuable asset in their estate, and it is important to ensure that the transfer of that asset is done in a way that is safe, secure, and does not penalize the beneficiary. At Wakefield Law, we encounter clients on a weekly basis who are incredibly concerned about the best way to transfer their home to their beneficiaries.

0 kommentar(er)

0 kommentar(er)